Sell your house for cash to SmoothSale

Simply enter your details below to get a no-obligation cash offer for your house.

When making the decision to sell your house one of the first questions that comes to mind is: how much is this going to cost me?

When making the decision to sell your house one of the first questions that comes to mind is: how much is this going to cost me? The most obvious expense is estate agency fees, but there are a number of other fees that you should be aware of before selling your house If you’re curious to discover the true expense of selling your house then this is the guide for you!

We’ll cover major costs like estate agency fees, conveyancing costs and mortgage fees, as well as less well-known expenses such as energy performance certifications (EPC), property preparation, and removal costs. We’ll also give an overview of the taxes that you’ll be liable for when selling your house. Read on or use the menu below to navigate easily.

Typically, estate agents charge commission when they sell your home. This means they will take a percentage of the final sale value of your property. Most high street agents charge between 0.75% and 3% to sell your home.

Let’s put these figures into practice. If your home sold for £250,000 you could see a minimum of £1,875 go into your agent’s pocket. At the opposite end of the scale, 3% commission would increase this cost to £7,500. The table below highlights these rates against different final sale values:

| Final Sale Value of Property | 0.75% Estate Agent Commission | 3% Estate Agent Commission |

|---|---|---|

| £200,000 | £1,500 | £6,000 |

| £250,000 | £1,875 | £7,500 |

| £300,000 | £2,250 | £9,000 |

| £400,000 | £3,000 | £12,000 |

| £500,000 | £3,750 | £15,000 |

| £700,000 | £5,250 | £21,000 |

Choosing the right estate agent when selling your property is crucial to selling your house quickly and to keep costs as low as possible. You shouldn’t assume that the most expensive estate agent is automatically the best. Some things to consider when choosing an estate agent are:

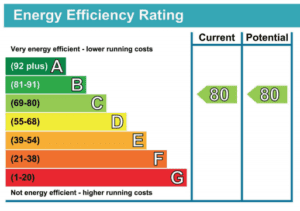

The EPC is a summary of the energy efficiency of your property and gives an indication of the general energy costs that a buyer can expect. An EPC is a legal requirement to sell your house and remain valid for 10 years after production. The EPC generally costs between £60 and £120 and grades homes on a scale of A to G for energy efficiency, with A being the most efficient and G the least.

Conveyancing costs can broadly be divided into two parts: the legal fee (i.e. the amount charged by the solicitor for the legal work undertaken) and the disbursements for third parties undertaking work like searches etc. The biggest disbursements are typically the transfer of ownership and title deeds copy. These conveyancing costs form a significant portion of the cost of selling your house and are even greater if you choose to take out home indemnity insurance.

Conveyancing fees are normally relative to the value of the property, averaging between £750 and £1500 (figures from Homeowners Alliance). Disbursements can add an additional £620:

| Disbursement | Cost |

|---|---|

| Title Deeds | £25 |

| Property Fraud Fee | £10 |

| Transferring Ownership | £200-300 |

| Bank Transfer | £20-30 |

| Money-laundering Checks | £3,750 |

| Searches | £250 |

Comparemymove offers a great tool to compare conveyancers and their costs so you can choose the right one for you.

Simply enter your details below to get a no-obligation cash offer for your house.

GET MY OFFERRemoval costs can make up a large part of your sale expenses and obviously depend on the size of your house and how many possessions you have to move. If you are moving from a small property such as a one bed flat then it’s possible to do this yourself and save yourself some cash. However, if you have a larger property or just want professional help to move you could end up paying between £230 and £1,440.

The amount you end up paying will depend on:

Compare removal companies using this handy guide from Which?

There are typically two options for your mortgage when moving a house: porting or remortgaging. Porting your mortgage just means moving the mortgage from the property you originally borrowed against to your new property. If you’re upsizing or moving to a more expensive property then you may need to borrow more, this will require remortgaging.

If you’re porting your mortgage you may be subject to a mortgage exit fee (MEAF). These typically range from £50 to £300. If you’re paying off your mortgage completely as part of your move (perhaps because you’re downsizing) you can expect to pay an early mortgage repayment charge of between 1% and 5% of the loan amount. This will obviously increase the cost of selling your house, particularly if you’re already in arrears on your mortgage.

Preparing your property to look its best for a sale is a cost that will really pay dividends and is often overlooked by home sellers. A well presented property is a must to attract prospective buyers. We’ve broken down some of the costs associated with preparing your property for a sale:

| Service | Cost |

|---|---|

| Professional Clean | ~£25 per hour |

| Deep Clean | £300 |

| Damp | £280 per wall |

| Garden | £250 |

If you need some inspiration for home improvement check out our guide on adding value to your property.

Depending upon the value of your house and whether or not you own multiple properties, you may be liable to pay capital gains tax (CGT). This will influence how much it will cost to sell your house.

If you’re looking to massively reduce the cost of your house sale and simplify the process then consider selling your house for cash to a reputable quick sale company like SmoothSale.

Our cash house buyers service is designed for vendors looking for a guaranteed sale of their property in as little as 7 days. Alternatively, we offer an ‘Investor Marketing’ route to market for vendors who want to sell their property to our network of trusted investors in under 30 days.

Get a cash offer today! Alternatively, get in contact on 0800 368 8952.

Simply enter your details below to get a no-obligation cash offer for your house.

Simply enter your details below to get a no-obligation cash offer for your house.